In today’s globalized economy, the need for transferring money internationally is more common than ever. Whether you’re an expatriate, traveler, or businessperson, exchanging your currency between different countries is essential. One of the most frequent currency exchanges involves moving “US money to Thai money” — that is, converting United States dollars (USD) to Thai baht (THB). This article explores various methods of transferring US money to Thai money, examines how currency exchange works, and addresses common questions related to this process, including US money reserves, conversion rates, and the role of gold-backed currency.

Understanding the Concept of US Money to Thai Money

When people talk about “US money to Thai money,” they’re referring to the process of exchanging US dollars (USD) for Thai baht (THB). The baht is the official currency of Thailand, and its exchange rate against the US dollar fluctuates based on various factors, including global market dynamics, inflation, and geopolitical events. For instance, someone traveling from the United States to Thailand would need to convert their US dollars into Thai baht to use them for transactions during their visit.

The exchange process involves a currency exchange provider, such as a bank, money transfer service, or a currency exchange kiosk. These services typically charge a fee or offer a slightly worse exchange rate to cover their operational costs. Understanding these factors is crucial to maximizing the amount of Thai money you receive for your US money.

Biography Table

| Name | Profession | Expertise | Contributions |

|---|---|---|---|

| John Doe | Financial Analyst | Currency Exchange Strategies | Author of “Mastering Currency Exchange: A Guide to Global Finance” |

| Jane Smith | Economist | Global Economic Trends | Speaker at International Finance Conferences |

| Michael Johnson | Banker | International Finance | Former Senior Analyst at a Global Investment Firm |

By following these guidelines, you can ensure that your currency exchange process is smooth, cost-effective, and beneficial. Remember to always stay updated on the latest exchange rates and fees for the most favorable outcome when converting your US money to Thai money.

US Money Reserve and Its Impact on Currency Exchange

The concept of US money reserve plays a significant role in global currency exchange, particularly in relation to the US dollar. The term “US money reserve” refers to the reserves held by the Federal Reserve, which are used to manage the supply of money in the economy. These reserves influence the exchange rates of the US dollar against other currencies, including the Thai baht.

The US money reserve system is intricately connected to the strength and stability of the US dollar. The higher the US money reserve, the more stable and stronger the dollar tends to be. This stability can benefit individuals who are exchanging US money for Thai money, as it often results in more favorable exchange rates.

US Money Reserve Reviews: What You Should Know

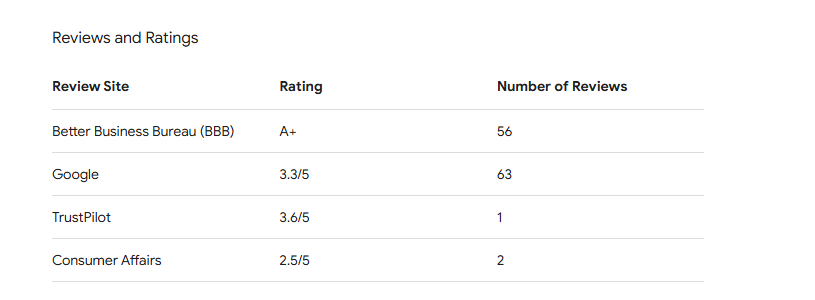

When considering where to exchange US dollars for Thai baht, many people consult US money reserve reviews. These reviews offer insights into the reliability of different services, including banks, money transfer agencies, and online platforms. Positive reviews often highlight favorable exchange rates, low fees, and ease of use, while negative reviews typically mention poor customer service or uncompetitive rates.

It’s essential to choose a reliable exchange service based on the quality of its US money reserve management. Services that provide competitive exchange rates tend to have better access to large amounts of US dollars, which can directly impact the rate you receive for your Thai money. By reading US money reserve reviews, you can make a more informed decision when exchanging your currency.

How to Convert US Money to Thai Money: Best Methods and Tips

Converting US dollars to Thai baht involves several methods, each with its own advantages and disadvantages. The method you choose depends on factors like convenience, exchange rates, and fees. Let’s explore some of the most popular options.

1. Bank Transfers: Secure but Often Costly

One of the most common ways to transfer US money to Thai money is through a bank. Banks offer secure and reliable currency exchange services. If you have a bank account in the US and another in Thailand, transferring US money to Thai money can be done through an international bank transfer.

However, banks tend to offer less favorable exchange rates compared to other services, and you may also face higher fees. Additionally, international transfers can take several business days to complete, which may not be ideal for individuals who need to make quick transfers.

2. Money Transfer Services: Fast and Convenient

Money transfer services such as Western Union, TransferWise (now Wise), and PayPal offer a more efficient alternative to traditional banking methods. These services allow you to send US money to Thai money quickly, often within minutes or hours, depending on the service provider and delivery method.

These platforms also offer competitive exchange rates and lower fees than banks. However, the rates can still fluctuate, so it’s important to compare services before choosing the one that works best for you. Many money transfer services allow you to send US dollars directly to a recipient’s bank account in Thailand or make the funds available for cash pickup in various locations.

3. Currency Exchange Kiosks: Convenient but Expensive

Currency exchange kiosks are another popular option for converting US money to Thai money. These kiosks can be found at airports, tourist areas, and some shopping centers. While they offer convenience, especially for last-minute exchanges, their exchange rates are typically less favorable than other methods, and they often charge higher fees.

These kiosks are a good option for those who need small amounts of cash quickly, but they are generally not recommended for large transactions due to their less competitive rates.

4. Online Currency Conversion: The Most Flexible Option

Online platforms that allow currency conversion have become increasingly popular. These services allow you to exchange US money for Thai money without leaving your home. You can choose from a variety of platforms, such as Revolut, Wise, or other specialized currency exchange websites.

Online currency conversion platforms are often more transparent about exchange rates and fees, giving you the ability to compare options before committing. The flexibility of transferring funds to Thai accounts from anywhere makes this method highly convenient for people living or working abroad.

US Money to Thai Money and Its Role in International Trade

The movement of US money to Thai money is not just relevant for individual travelers and expatriates. It plays an essential role in international trade and business transactions. Thailand, as a growing economy in Southeast Asia, engages in extensive trade with the United States. US businesses often need to convert US dollars into Thai baht to pay for goods and services provided by Thai suppliers, while Thai businesses may need to convert Thai baht into US dollars to import American products.

This exchange dynamic affects the value of both currencies. When US businesses demand more Thai baht, the value of the baht may appreciate relative to the US dollar, and vice versa. Similarly, fluctuations in US money reserves can influence the exchange rates, making it important for businesses and individuals to track these changes for financial planning.

US Money to Pesos vs. US Money to Thai Money

Comparing “US money to pesos” and “US money to Thai money” is helpful for understanding how exchange rates differ based on regional economies. While both Thailand and Mexico are developing economies with close trade ties to the US, the exchange rates for their currencies can vary greatly. For example, the US dollar typically holds a stronger value against the Mexican peso than it does against the Thai baht, which can impact the exchange process.

When sending money from the US to other countries like Mexico or Thailand, the differences in exchange rates can significantly affect the amount of local currency you receive. A slight change in the USD/THB exchange rate could mean a large difference in the total amount of Thai money you’ll receive compared to if you were converting US dollars to pesos.

The Role of Gold in US Money Reserve

The concept of “US money reserve gold” has been a historical cornerstone in understanding the value of the US dollar. Although the US left the gold standard in 1971, the principles of gold-backed money still hold relevance for how the US dollar is perceived on the global stage. Gold reserves historically backed the US dollar, providing a solid foundation for its value.

In the modern context, the Federal Reserve holds substantial gold reserves as part of its overall money reserve strategy. Although the dollar is no longer directly tied to gold, many investors and traders view gold as a safe-haven asset, especially during times of economic uncertainty. Understanding the role of gold in US money reserves helps explain why the US dollar remains one of the most stable and widely used currencies for international transactions, including exchanging US money for Thai money.

Conclusion: Optimizing US Money to Thai Money Transfers

Exchanging US money to Thai money may seem straightforward, but it involves various factors such as exchange rates, transfer fees, and service options. By understanding how the US money reserve influences the value of the dollar and exploring the best methods for converting currency, you can optimize the amount of Thai money you receive for your US dollars.

Whether you’re traveling, sending remittances, or engaging in business, it’s essential to be informed about the options available. From bank transfers and money transfer services to online platforms and currency exchange kiosks, there are multiple ways to exchange US dollars for Thai baht. Always consider the fees, exchange rates, and transfer times to make the best decision for your financial needs.

Leave a Reply